Our monthly property market review is intended to provide background to recent developments in property markets as well as to give an indication of how some key issues could impact in the future.

We are not responsible or authorised to provide advice on investment decisions concerning property, only for the provision of mortgage advice.

The housing market showed signs of subdued growth in September, according to the latest UK Residential Market Survey from the Royal Institution of Chartered Surveyors (RICS)

The report revealed that new buyer enquiries fell for the third consecutive month, with a net balance of -19% in September. Sales activity also remained in negative territory at -16%, although this marks an improvement on August’s figure of -24%. Meanwhile, new listings declined for the second month in a row, reaching -15%. This caution among buyers and sellers is likely due to the upcoming Autumn Budget, which has caused widespread uncertainty.

In the rental market, tenant demand remained broadly flat at -1%, however landlord instructions fell sharply to -38%, the lowest level since May 2020. This reflects an ongoing trend of landlords leaving the sector, leading to a continued imbalance between supply and demand. As a result, RICS expects rents to rise by around 3% over the next year.

The government has launched a consultation to overhaul the home buying and selling system.

It currently takes an average of 120 days to complete a transaction after an offer has been accepted, hence the need to make the process simpler, faster and more reliable.

One key proposal is to ensure that comprehensive information about a property is available at the point of listing. The government notes that this approach has helped to deliver ‘faster, more certain transactions in Scotland.’ To support this, there is a proposal for the widespread use of digital property packs, which would store current and historic details about a home.

As things stand, buyers and sellers can withdraw from a transaction at any point up until the exchange of contracts. To reduce fall-throughs, proposed reforms could include the use of conditional contracts, which would make the transaction binding at an earlier stage. If a party withdrew, they would typically face a financial penalty.

Appleby Blue Almshouse in Southwark, south London, has won the 2025 Royal Institute of British Architects (RIBA) Stirling Prize for Britain’s best new building.

Designed by Witherford Watson Mann, the development reimagines the traditional almshouse to address loneliness and provide affordable, high-quality housing for people over 65. The complex contains 59 flats alongside communal areas, including a courtyard, roof garden and community kitchen, all designed to foster connection and wellbeing.

Judges praised the project for ‘setting an ambitious standard for social housing among older people,’ with jury member, Ingrid Schroder, highlighting its “high-quality” and “thoughtful” design that “truly cares for its residents.”

Features such as terracotta-paved hallways with benches and plants, and a central water feature, create what RIBA described as an ‘aspirational living environment’ that contrasts sharply with the ‘institutional atmosphere often associated with older people’s housing.’

The latest data from Savills reflects a commercial property market that could either be considered as stable or sluggish.

The figures indicate the commercial market is holding its ground against a backdrop of ongoing economic and political uncertainty. Since February, the average prime yield has remained steady at 5.9%, suggesting a degree of predictability despite wider market pressures. While four sectors are showing a downward trend, seven sectors have not changed for at least 18 months. While this may spark concern about stagnation, it could also offer reassurance for investors who are prioritising consistency.

There are some positive signs for the market. In the second quarter of this year, commercial property investment reached the second-highest level recorded in the past 13 quarters. Looking ahead, Savills predicts that, by the end of 2025, total investments volumes for office and industrial sectors will exceed the 2024 total.

UK hotel investment showed strong growth in the third quarter of this year according to Savills

Total hotel investment reached £1.04bn in Q3, marking a 28% year-on-year increase. This growth was largely driven by single asset transactions, which represented 92% of all activity and was nearly 60% above the ten-year average for Q3.

London was the investment hotspot in Q3, with total volumes rising by 42% year-on-year to £697m. Savills suggested that this strong performance was due to the capital’s large share in hotel stock combined with a rebound in investor appetite.

David Kellet at Savills commented, “While the first half of the year was defined by operational and investor uncertainty in the UK hotel market, sentiment has stabilised through Q3.” He added, “We expect the single asset market to remain robust whilst also anticipating more larger portfolios to transact in 2026.”

Analysis from Knight Frank shows a total of £1.46bn was invested in Scotland’s commercial property market during the first three quarters of 2025.

Although this represents a 21% decline compared with the same period last year (£1.85bn), it remains broadly in line with the average levels for Q3 during 2020-2024.

So far this year, retail is the sector that has attracted the highest volume of investment, totalling £452m. The industrial sector also performed strongly, recording its second-best third quarter since the pandemic, with completed deals worth £153m. International investors are on track to have their highest share in investment since 2022, accounting for 45.9% of deals in the first three quarters of the year.

Alasdair Steele at Knight Frank observed, “Fewer deals are happening, but the assets that are trading hands tend to be higher quality buildings in prime locations and are attracting a good deal of interest.”

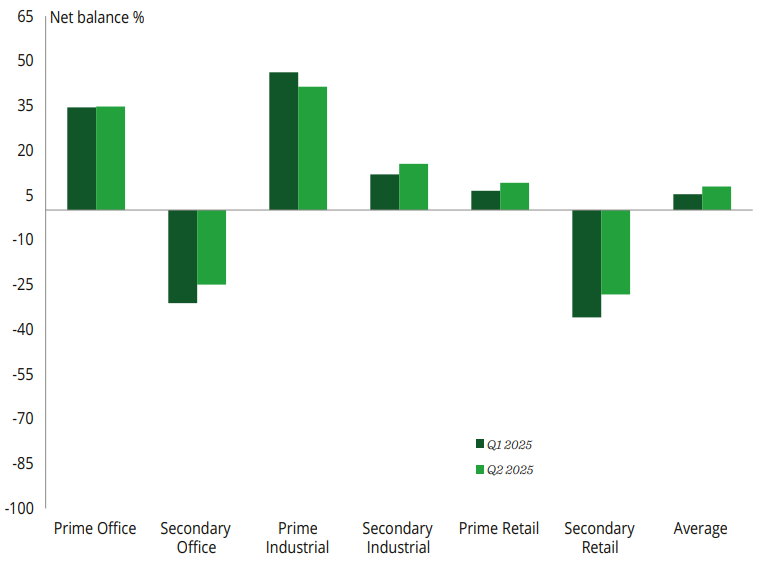

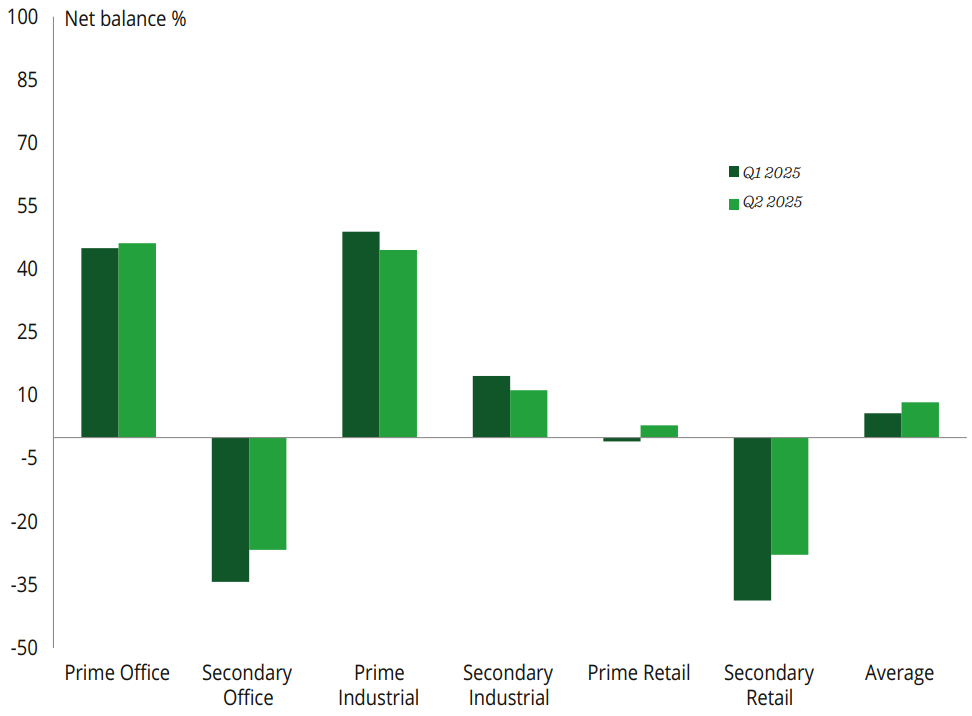

12-month capital value expectations – broken down by sector

All details are correct at the time of writing (22 October 2025)

Source: RICS, UK Commercial Property Monitor, Q2 2025